On 14 July 2021, the Commission adopted a proposal for a new Carbon Border Adjustment Mechanism which will put a carbon price on imports of a targeted selection of products so that ambitious climate action in Europe does not lead to ‘carbon leakage’. This will ensure that European emission reductions contribute to a global emissions decline, instead of pushing carbon-intensive production outside Europe. It also aims to encourage industry outside the EU and our international partners to take steps in the same direction.

Climate change is a global problem that needs global solutions. As we raise our own climate ambition and less stringent environmental and climate policies prevail in non-EU countries, there is a strong risk of so-called ‘carbon leakage’ – i.e. companies based in the EU could move carbon-intensive production abroad to take advantage of lax standards, or EU products could be replaced by more carbon-intensive imports.

Such carbon leakage can shift emissions outside of Europe and therefore seriously undermine EU and global climate efforts. The Commission’s proposal for a Carbon Border Adjustment Mechanism (CBAM) should prevent the risk of carbon leakage and support the EU’s increased ambition on climate mitigation, while ensuring WTO compatibility.

The CBAM will equalise the price of carbon between domestic products and imports and ensure that the EU’s climate objectives are not undermined by production relocating to countries with less ambitious policies. It also aims to encourage industry outside the EU and our international partners to take steps in the same direction.

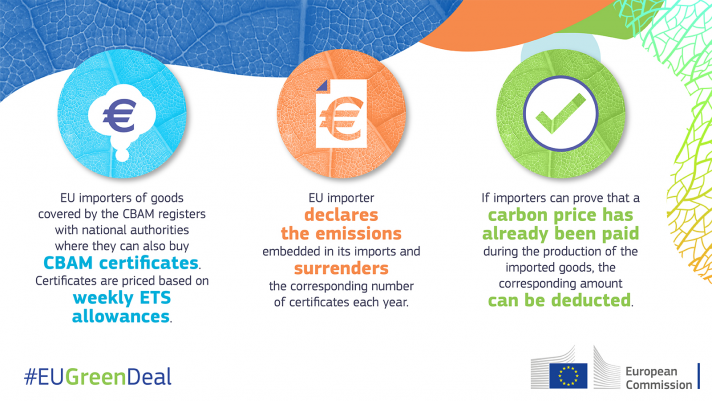

Designed in compliance with World Trade Organization (WTO) rules and other international obligations of the EU, the CBAM system will work as follows: EU importers will buy carbon certificates corresponding to the carbon price that would have been paid, had the goods been produced under the EU’s carbon pricing rules. Conversely, once a non-EU producer can show that they have already paid a price for the carbon used in the production of the imported goods in a third country, the corresponding cost can be fully deducted for the EU importer. The CBAM will also help reduce the risk of carbon leakage by encouraging producers in non-EU countries to green their production processes.

To provide businesses and other countries with legal certainty and stability, the Carbon Border Adjustment Mechanism will be phased in gradually and will initially apply only to a selected number of goods at high risk of carbon leakage: iron and steel, cement, fertiliser, aluminium and electricity generation. A simplified CBAM system, where importers will have to report emissions embedded in their goods without paying a financial adjustment will apply as from 2023 for selected products with the objective of facilitating a smooth roll out and to facilitate dialogue with third countries.

Once the definitive system becomes fully operational in 2026, EU importers will have to declare annually the quantity of goods and the amount of embedded emissions in the total goods they imported into the EU in the preceding year, and surrender the corresponding amount of CBAM certificates.

Proposal for a Carbon Border Adjustment Mechanism

Source: https://ec.europa.eu/taxation_customs/green-taxation-0/carbon-border-adjustment-mechanism_en